Financial Strategies for a Strong Post-Divorce Foundation

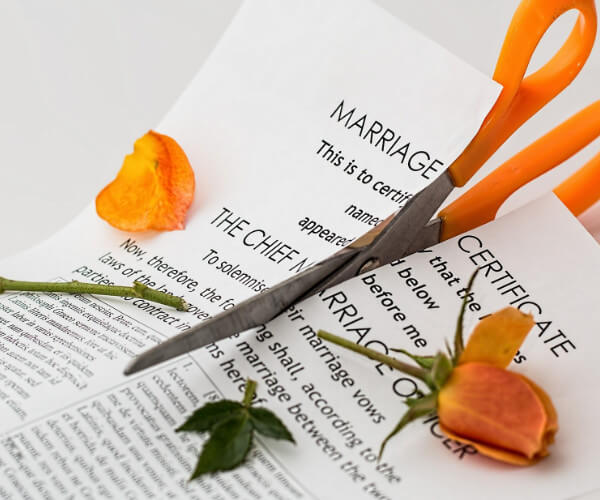

Divorce is undeniably a life-altering event. In just about every case, it takes an emotional toll– and it often has significant financial implications.

As you go about the process of navigating your divorce, be sure to have a solid plan in place in order to secure your financial future. You can take advantage of some key financial strategies that can help you to build a strong post-divorce foundation, and regain control of your financial wellbeing.

Assess your current finances

The first step: take a close look at your current financial situation.

Round up all of your financial documents, like bank statements, tax returns, investment portfolios, and retirement accounts. All of these documents can help you to form a clear picture of your assets, liabilities, and cash flow, which is necessary to help you make the best possible decisions for your financial future.

Create a new budget

Once you’ve gathered all of your financial data and have formed an understanding of your situation, it’s time to create a realistic budget that’s tailored to your post-divorce life. This budget should cover essentials like housing and utilities, groceries, and transportation, plus any non-essentials– for example, entertainment or travel.

While you’re constructing this budget, don’t forget to allocate funds for savings and emergency expenses.

Reevaluate your financial goals

Every divorce scenario is different, but you might find that divorce has necessitated a reevaluation of your financial goals.

Take the time to identify some new objectives that are in alignment with your new circumstances. These might include saving for your children’s education, building an emergency fund, or planning for retirement.

In any case, having clearly-defined goals can help you to stay on top of your finances and make good progress toward achieving them.

Fully understand alimony and/or child support

If you’re entitled to alimony or child support, make sure that you fully understand all of the legal aspects of these payments. We’d recommend consulting with an attorney specializing in family law, or a financial advisor, to ensure that you’ll receive the proper support– and that it’s factored into your budget and long-term financial planning.

Update your documents

As you begin a new chapter in your life, remember to update all of your legal and financial documents.

These documents might include your will, power of attorney, beneficiary designations, and insurance policies. Make sure these documents accurately reflect your current wishes and beneficiaries.

Build up your emergency fund

Having an emergency fund is an absolute necessity for financial security. Since divorce can be an expensive process, you may have had to use some or all of your emergency fund during the divorce proceedings. If this is the case, focus on rebuilding it as soon as possible.

Making sure to keep an emergency fund is important for covering unexpected expenses without derailing your financial goals.

Manage debt wisely

Sometimes, divorce leads to the division of joint debts. Make a plan to address any outstanding debts you might have, and work towards paying them off. Prioritize the highest-interest debts first, and if necessary, explore debt consolidation options to streamline your financial obligations.

Seek professional guidance

Divorce is a complicated process– but post-divorce planning and reevaluation can be just as complicated and overwhelming. If you need help or insight, don’t hesitate to seek the help of an attorney or financial planner.

If you’re dealing with divorce proceedings or are in need of legal assistance, reach out to Digby Law Firm for a consultation today.

Financial Equity in Divorce

Divorce can be a complex and emotionally charged process, often involving various issues like child custody, property division, and financial support. One of the most critical aspects of divorce proceedings is achieving financial equity, ensuring that both parties...

Custody Agreements: Exploring Arkansas Norms

When navigating the complexities of child custody agreements, understanding the legal landscape in Arkansas is crucial. The state has its unique set of norms and regulations that influence how custody is determined, modified, and enforced. This comprehensive guide...

Protecting Your Rights and Responding to Sex Offense Allegations

Sex offense allegations can be incredibly damaging to your life, reputation, and emotional wellbeing. If you find yourself facing these allegations, it’s essential to understand your rights and take the right steps to protect yourself. We’ve put together a general...